Improve Payment Efficiency and Expedite Project Timelines with Built

Anyone who has worked in construction can likely understand the complications associated with what might seem like a simple payment — because typically, the transaction isn’t actually that simple. The truth of the matter is the payment ecosystem can be a bit convoluted.

Typically, a lender or owner allocates money to the general contractor or builder who then pays their subcontractors, vendors, and suppliers as necessary. But the transfer of dollars from the general contractor to those further down the ladder isn’t quite as straightforward as simply handing over a check once work is completed. To ensure compliance amongst all parties involved, legal documents called lien waivers must be filled out before payment can be remitted.

Legal Documentation + Subsequent Payments Slow Down Project Timelines

A legal document that serves as a receipt for a payment, lien waivers, are essential in the construction industry. Basically, a lien waiver is an agreement between a payer (like a GC) and payee (like a subcontractor) in which the payee acknowledges having been paid for their work, and as a result relinquishes their right to place a lien on the property. These docs are a necessary antecedent to the payout keeps the project progressing.

In the “old days” the lien waiver and payment process took weeks to complete, and typically it looked something like this:

Legacy Lien Waiver + Payment Process

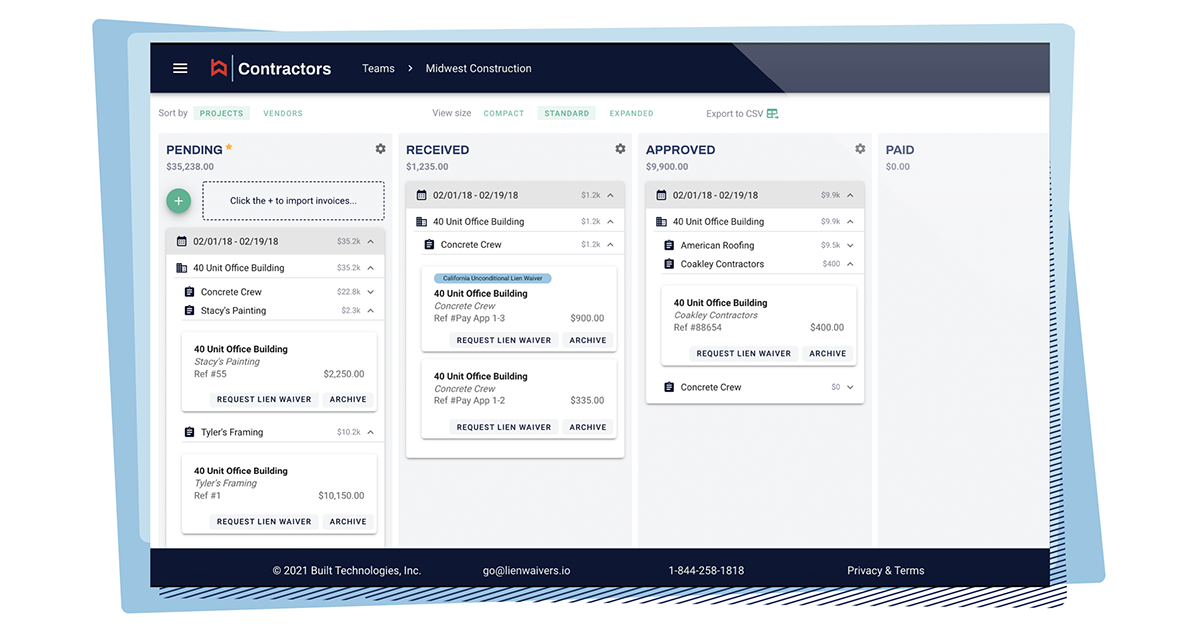

But with the availability of technology like Built’s Lien Waiver Management Software, the lien waiver process has been drastically modernized. Whereas it could take multiple weeks to complete the necessary documentation using the analog method shown above, Built facilitates the process in a single day on average.

Built Lien Waiver Management

That being said, the lien waiver process is only half the battle. Being able to post expedient payments is the second — and arguably more important — leg of this financial relay. Cutting paper checks is an obviously slower form of payment due the tangibility of paper checks, but the pace and capabilities of differing electronic payments can also make an impact on the payment ecosystem as a whole.

Comparing Payment Models

Let’s take a look at the available payment structures available in conjunction with Built, and compare how they get subcontractors paid for their work.

Built Lien Waiver Management + Traditional Paper Checks

Built Lien Waiver Management + Bank ACH Payments

Built Lien Waiver Management + Built Pay

Why Built Pay is The Superior Construction Payment Solution

Built’s web-based software simplifies and streamlines the payment ecosystem from start to finish.

Builders gain clear visibility over lien waiver statuses, and can even batch-create and -send lien waivers with a few quick clicks. Subcontractors can then sign waivers directly from their smartphone, computer, or tablet and send it back within seconds. And nearly just as quickly, payment can be automatically posted via Built Pay, depositing the money into the recipient’s preferred account.

So, what makes Built Pay better than that of a bank’s ACH capabilities? Complete control with a single click.

While manual ACH payments would necessitate a builder becoming an ACH Account Administrator, handling all communication with their vendors in order to pay them, Built Payments transpire with one press of the mouse.

Built Pay makes it easy to collect tax documents like W-9’s from new subcontractors, offers branded email templates so your subcontractors will easily recognize important messages even if they’ve never used the program, and supports frictionless bank account authentication. In addition, by using Built, builders do not have to worry about notices of changes, positive pay, same-day and next-day ACH, while always having access to audit trails keeping everyone up-to-date on the exact payment status.

Manual ACH payments, on the other hand, add additional steps to your already-complicated payment structure: it requires builders to physically collect, store, and update ACH account and routing numbers, and then take action yet again to authorize the payment once the lien waiver has been signed and received. These additional steps not only introduce risk, but also add a ton of extra time to the general contractor’s already-tight timelines.

Instead of adding in more steps for builders, general contractors, and project managers, Built streamlines and secures the process, so that everyone can get to building, faster. Mitigate risk, improve visibility, and accelerate project timelines with the power of Built Pay — the superior construction payment solution.

Ready to learn more?

Related Posts

The Case for Streamlining Construction Financials—From Budget to Pay App