Identifying Opportunities In CRE: Industrial Shows Strength

Commercial real estate is at a watershed moment, with stakeholders bracing for impact, particularly in sectors like office CRE.

As Moody’s analyst Blake Coules told Reuters, “It’s imperative that banks have rigorously scrutinized their CRE portfolios, clearly communicated the specific areas of exposure and their multi-scenario strategies for mitigating these risks.”

Amid this scrutiny and strategizing, lenders are seeking opportunities to diversify, and they don’t have to step outside CRE to do so. Industrial CRE positions itself as an area with real potential, even amidst storms in the greater CRE sector.

A case study for industrial CRE: Twin Cities

Not every geographical region is an industrial powerhouse, but there are many to choose from in the U.S. One such region is the Twin Cities, also known as Minneapolis–Saint Paul, Minnesota.

According to a recent report from commercial brokerage Colliers, the average vacancy rate for industrial buildings in Twin Cities sits around 4.5% for the first half of 2024. That’s lower than historical averages. To add to it, it’s in the single digits, something that can’t be said for the area’s office sector.

“Industrial rents are on the rise, with the average lease rate at $9.55 per square foot, nearly $2 more than a year ago,” writes the StarTribune. Though this environment is paired with a tight supply, industrial CRE remains healthy in the region.

Does the health of industrial CRE expand beyond one area?

National industrial CRE shows a similarly healthy outlook. Across the U.S., industrial construction starts have fallen, but demand for existing buildings remains high. As supply increases, tenant demand is likely to rise as well.

Houston has the most manufacturing jobs in the U.S., making it a prime industrial location. There, a vacancy rate of around 7% reflects a healthier market than other areas of CRE.

While CRE as a sector is living in a time of uncertainty, the scenario varies as you look deeper into the subsectors, like retail and industrial.

Practicing cautious optimism with active risk mitigation

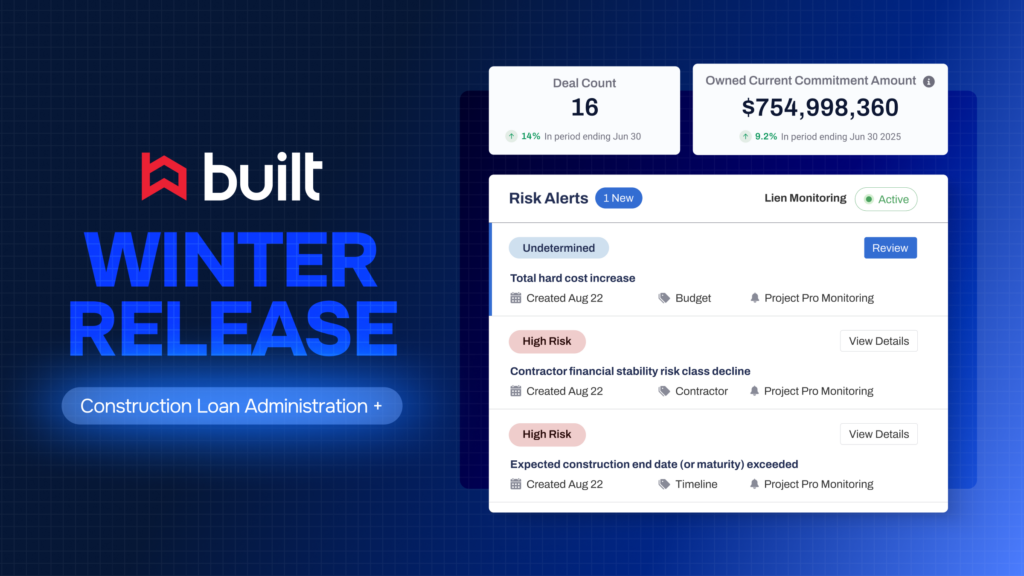

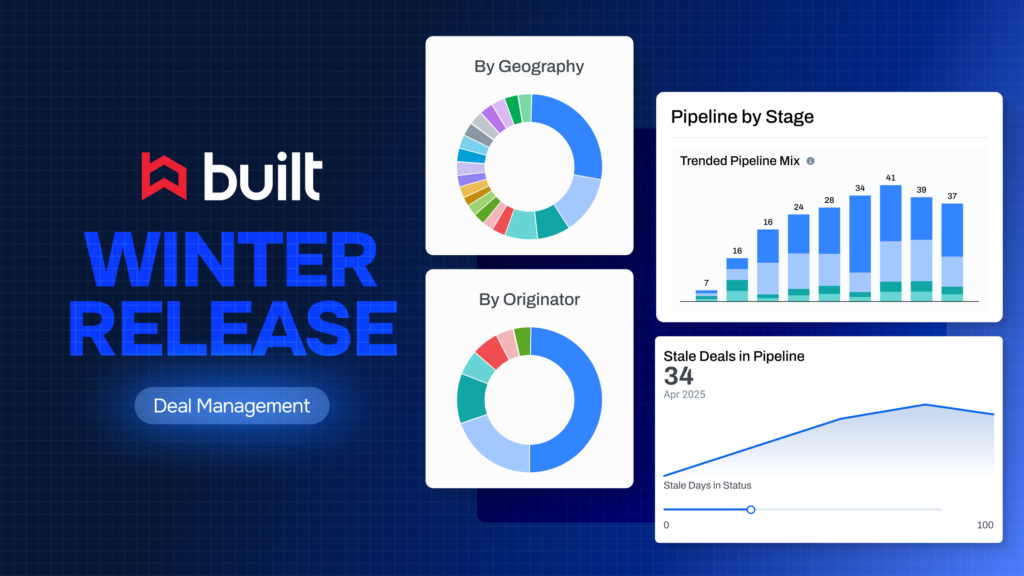

Opportunities in CRE are worth pursuing, but as any financial institution knows, optimism must be tempered with caution. Active risk mitigation using technology helps lenders achieve the perfect mix.

Many banks are overexposed to commercial real estate. One way to mitigate the risks associated with this is by setting aside an adequate allowance for loan and lease losses to help cover estimated losses on loans.

Additionally, managing risk with real-time data and identifying problem loans early will help maintain a healthy portfolio. Lenders can achieve this by automating their entire CRE deal lifecycle—from contractor due diligence, draw management, borrower collaboration, to streamlined portfolio management. This includes automated covenants, tenancy tracking, real-time reporting, and proactive portfolio alerts— all on Built’s comprehensive CRE platform, which is suitable for industrial CRE and beyond.

In industrial, as in other areas of CRE, taking advantage of opportunities while employing a calculated strategy just makes sense.