How to Mitigate Contractor RiskOn Every Construction Project

The right contractor can make or break a construction project–making contractor risk one of the most significant forms of risk associated with construction lending. At best, an incompetent contractor can be an inconvenience. At worst, they can create a dangerous work environment. Any contractor issues, regardless of severity, have the potential to derail even the most carefully planned projects–causing delays that cost lenders and other key stakeholders a significant amount of time and money. To effectively identify and mitigate contractor risk, lenders must first understand the common red flags that can potentially identify problematic contractors.

What are the common contractor risk factors?

Construction projects are complex and require the coordination of many different parties. When working with contractors, there are several risk factors that lenders need to be aware of. If not identified and addressed early, any of the risk factors detailed below can lead to serious project delays and create a ripple effect that jeopardizes the entire operation.

Diminishing Credit Limits & Delinquencies

Often, contractors will work on multiple projects at once to grow their business. Managing cash flow to purchase materials is a common struggle for many contractors who are taking on more jobs. By utilizing trade credit, contractors can delay material payments and keep more cash in hand. However, as contractors take on more projects, their credit limits can quickly be reached–putting them at risk of credit delinquency. Nobody wants to work for free–so when contractors can’t pay their subs or suppliers, construction halts.

Federal Tax Liens & Other Derogatory Filings

When a contractor has a federal tax lien filed against them, it indicates that they have failed to pay their federal taxes after being issued a demand for payment by the government. When a tax line is issued, the government has the right to seize a contractor’s personal property until the unpaid federal taxes are paid. If a contractor is not paying their taxes, they are either untrustworthy or in financial trouble–either of which can spell trouble for a construction project. Therefore, federal tax liens are a prominent red flag and can be a strong indicator of a problematic contractor.

Lapses in Licensure, Coverage, or Corporate Registrations

When it comes to contractors staying current on their licenses, coverages, and registrations, there are quite a few moving parts. It can be incredibly challenging for contractors, let alone lenders, to keep track of expirations, removals, and other lapses in required contractor documentation. However, if not caught early, these issues can open up the lender to a much greater loss if a project mishap occurs. Some common examples include:

Lack of insurance:

Insurance companies will not insure unlicensed contractors. If an unlicensed contractor completes faulty work or walks off the project with work left incomplete, the borrower is forced to absorb the cost–potentially leading to project delays and substantial financial losses for the borrower.

Injury liability:

An unlicensed contractor is an uninsured contractor–and when a contractor is uninsured they automatically become the direct responsibility and liability of the borrower. If an injury occurs on the job site, the injured contractor may file a lawsuit against the borrower, which can put a halt on the project until resolved.

Lack of required building permits:

Unlicensed contractors are also unable to obtain proper building permits–meaning the work they complete will likely not be built to code. Shoddy work not built to code may need to be repaired or replaced at the expense of the borrower–causing delays and potentially creating an unsafe work environment that can lead to injuries or worse.

Lenders need to have a solid grasp on the state of their contractor’s finances and documentation so they can proactively work with borrowers to address any potential issues that may negatively impact the project. Often, borrowers aren’t aware of contractor issues until it’s too late–making it even more important that lenders keep a close eye on contractor status. With proactive contractor monitoring, lenders can work with borrowers to remove risk-prone contractors before they become an issue. But, how can lenders consistently monitor contractors without significantly burdening their administrative teams?

How can lenders mitigate contractor risk?

A large amount of contractor risk can be mitigated by simple pre-closing due diligence and a thorough cost review of the project budget to validate feasibility. Lenders should verify the contractor’s financial stability along with their track record before accepting them and ensure the contractor has the proper licenses, certifications, and insurance for the project, and call trade references to make sure they are current on all their bills.

Unfortunately, contractor issues often arise on projects after the acceptance phase–issues that contractors often don’t self-report. A thorough assessment of the contractor’s tax returns, public filings, balance sheets, income statements, and overall financial profile helps significantly lessen the likelihood and severity of a loss for the lender. However, doing so manually is time-consuming, prone to human error, and nearly impossible to do consistently. Because manual contractor monitoring often isn’t feasible in the capacity to be effective, lenders need a way to automate the process.

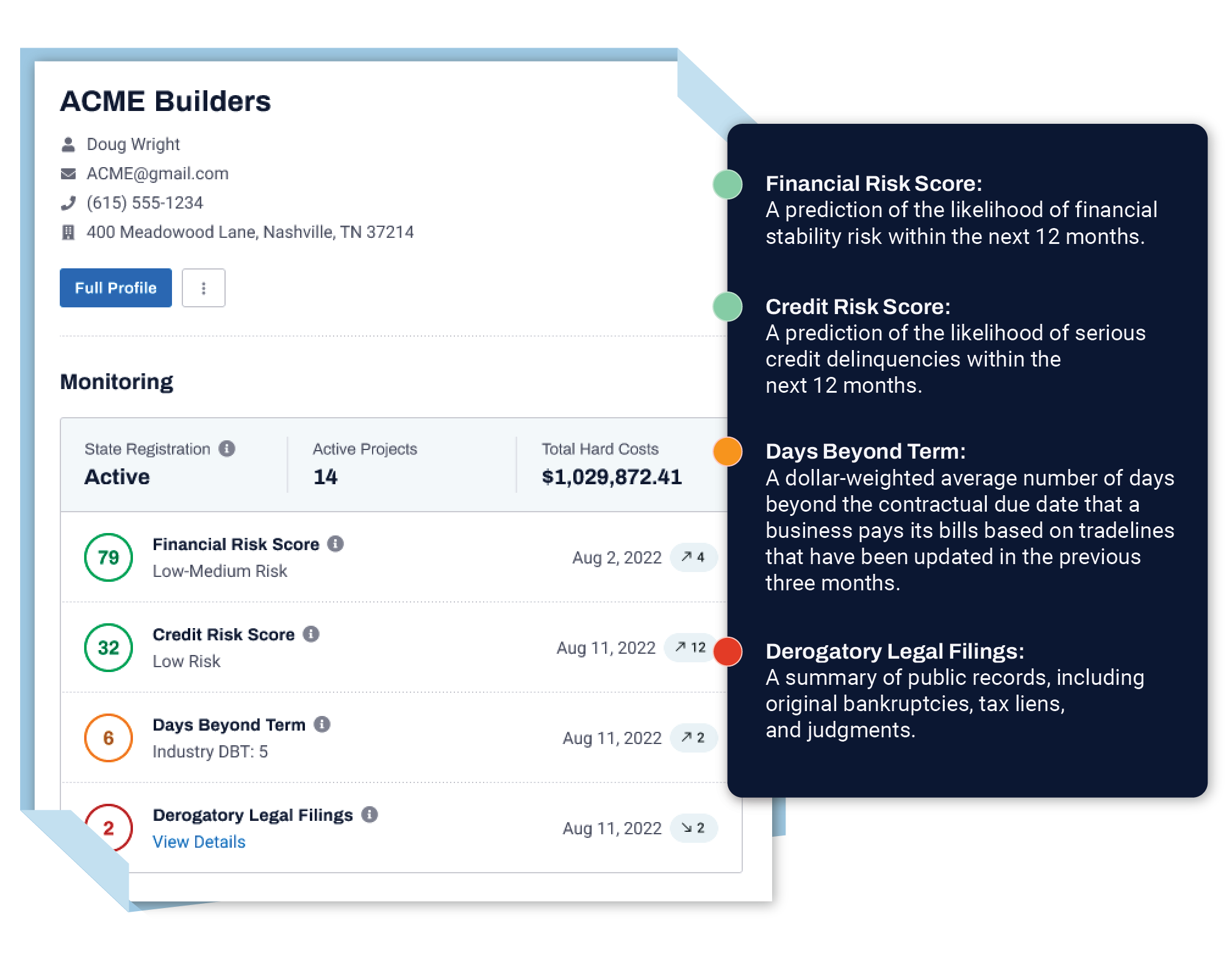

Built’s digital Project Monitoring solution uses tradeline and collections information, public filings, and other variables to alert lenders to potential contractor risk. This data is then compiled to help continuously monitor contractors on the project and actively alert lenders of potential risks–before a contractor or owner even self-reports them. Risk analysis data is presented clearly in Built’s platform–allowing lenders to proactively manage contractor risk before the potential for issues arises.

Start protecting your construction projects today.

Project Monitoring is just one part of Built’s Project Pro–a revolutionary suite of digital tools that empower lenders to mitigate risk on their construction projects.

Schedule a call with one of Built’s construction risk mitigation experts today to see how you can add Project Pro to your workflow. Or, check out the Project Pro Feature Deep Dive for a closer look into all the exciting risk mitigation solutions Project Pro provides.

Related Posts

Built Names Chris DeVito as Vice President of Product