State of the Nation’s Housing and Construction Industries 2018 [Infographics]

As we closed out 2017, Realtor.com and Oldcastle Business Intelligence released detailed reports on the state of the nation’s housing and construction industries accompanied by their projections for the year ahead. We compiled a list of the top trends and predictions from each report and put the key data points into two infographics for housing and construction.

Substantial growth within the housing and construction industries coupled with a strong and growing economy has lead to exponential growth in construction lending. Another major player leading to the expansion of the construction lending industry is the growth and adoption of

Housing Market Overview

2017 saw a continuation of the national housing shortage, which resulted in steep price appreciations due to the lack of inventory. The rise in housing prices combined with a decrease in available inventory, most notably in entry-level housing, continued to be a major difficulty plaguing millennials seeking entry into the housing market. Looking at the year ahead, reports show that we can expect to see an ease in inventory shortages, predominantly in Southern regions, resulting in more manageable housing prices and an uptick in first-time homebuyers. Millennials will continue to drive the housing market and are expected to gain majority market share across all price points in 2018.

{{cta(‘716f21ae-9ce8-436d-94d1-3dd782154903’)}}

Construction Industry Overview

As millennials continue to make their mark on the housing market, driving industry trends and needs, construction levels continue to increase in an effort to keep up with rising demands. 2018 is projected to see major growth in single-family housing starts with a predominant focus on Southern and Western markets.

{{cta(‘ac77034d-7410-4538-8425-704209ee4ef2’)}}

Pricing

Year-over-year housing price appreciations are expected to slow.

- National housing prices are projected to increase 3.2% in 2018, compared to a 5.5% increase in 2017

- Price appreciation for higher-priced homes is expected to slow

- Price appreciation for entry-level homes is expected to increase

- Housing inventory is expected to decrease by 4% year-over-year in Q1 2018

- Housing priced above $350,000 is expected to see the largest growth

- The first year-over-year increase since 2015 is projected for early fall of 2018

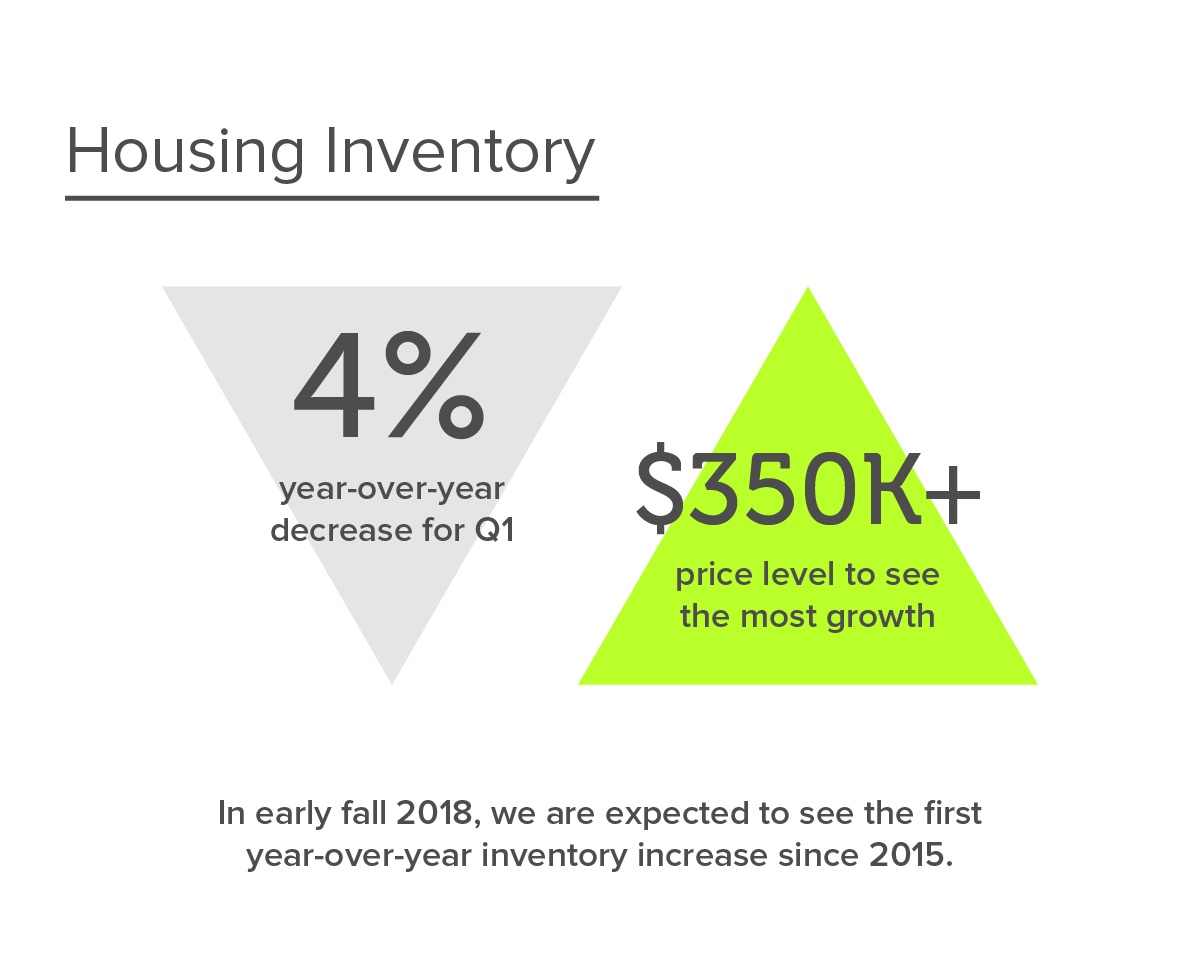

Inventory

Inventory shortages are expected to see some relief by year end.

- Housing inventory is expected to decrease by 4% year-over-year in Q1 2018

- Housing priced above $350,000 is expected to see the largest growth

- The first year-over-year increase since 2015 is projected for early fall of 2018

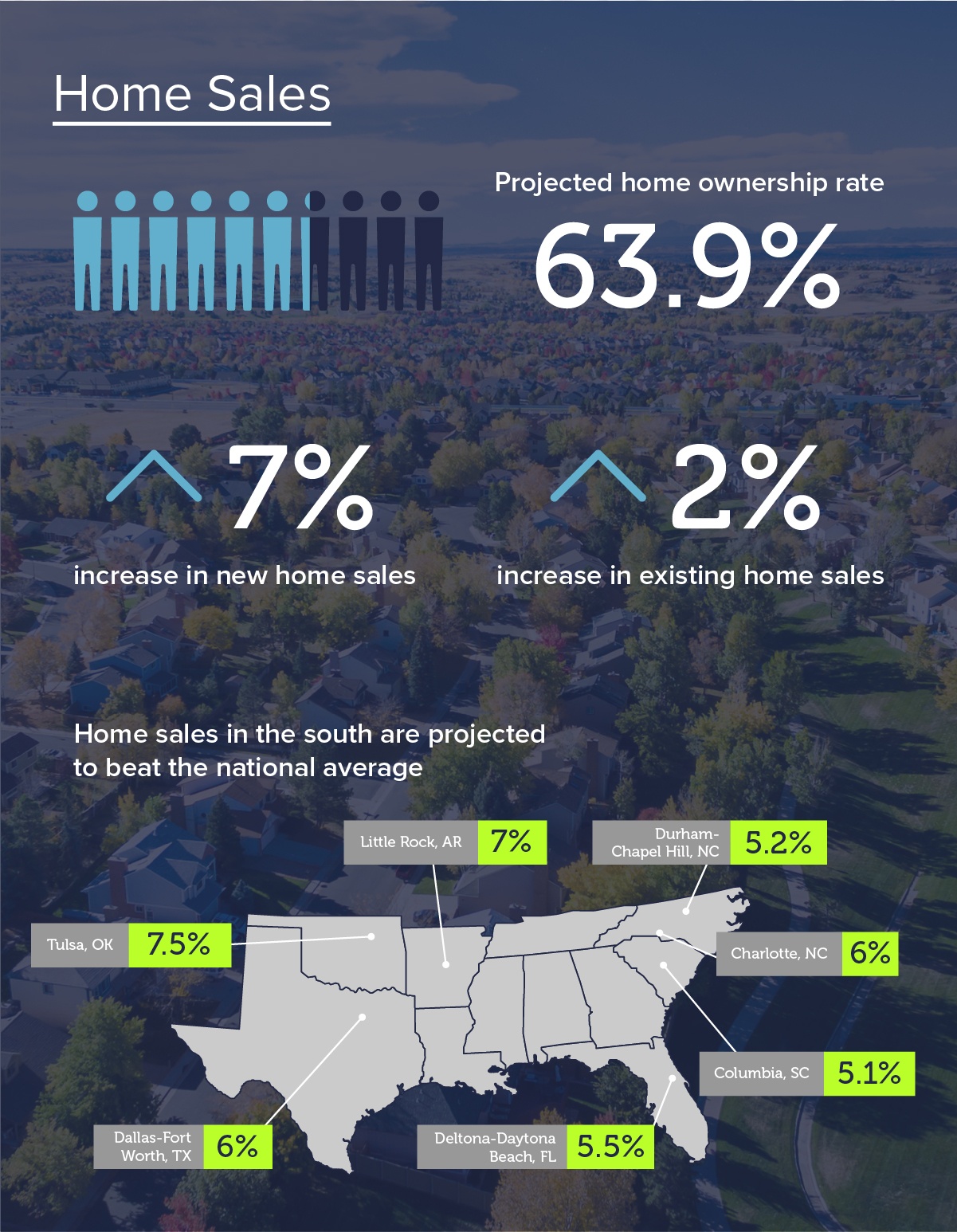

Sales

As inventory shortages stabilize and prices become more manageable, both new and existing home sales are expected to increase.

- National homeownership rate is expected to stabilize at 63.9%

- New home sales are expected to increase 7%

- Existing home sales are expected to increase 2.5%

- Home sales in the south are expected to beat the national average

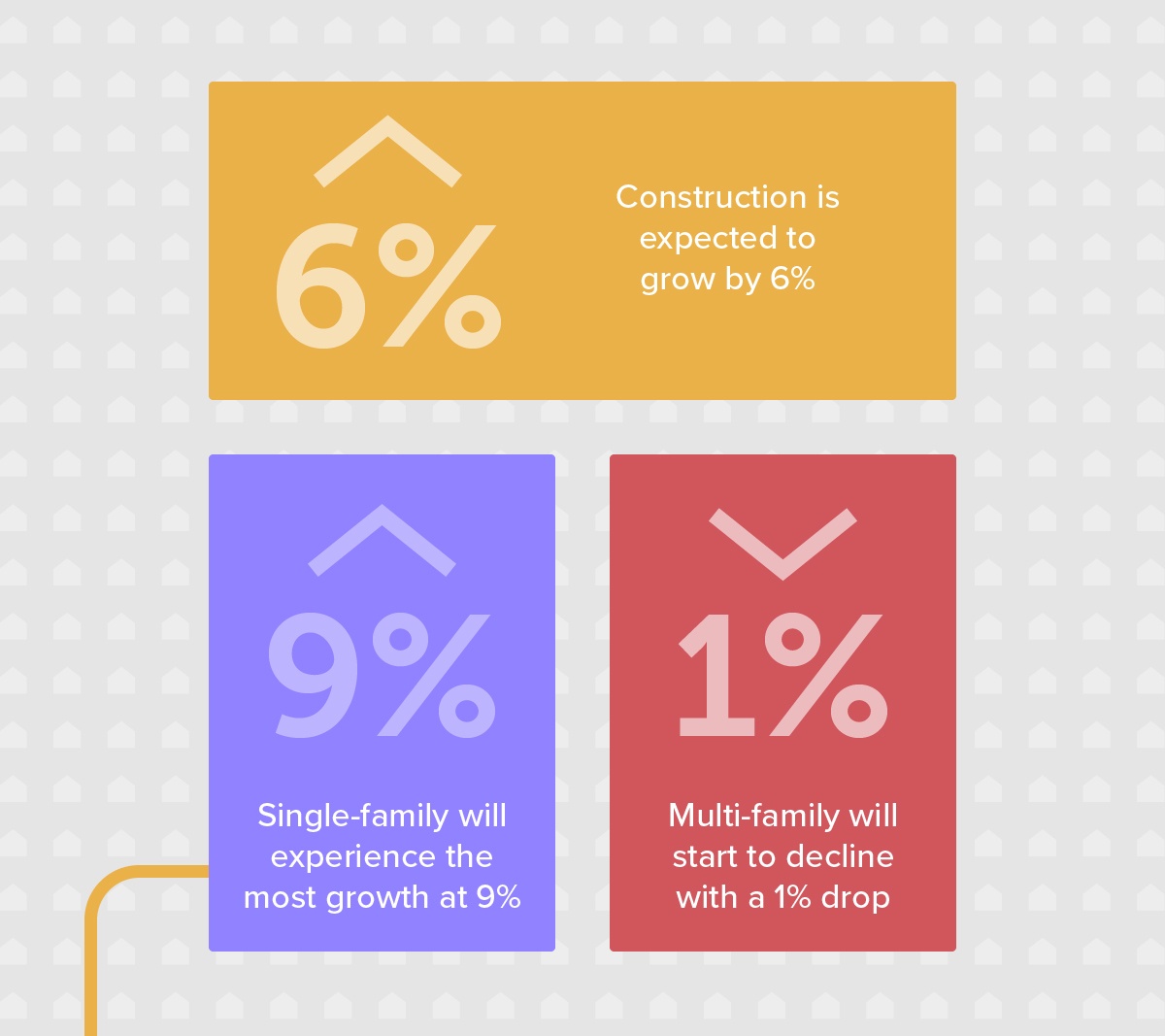

Construction Growth

Inventory shortages drive construction growth.

- Construction is expected to grow 6% in 2018

- Single-family housing starts projected to grow 9%

- Multi-family starts projected to see a 1% decline

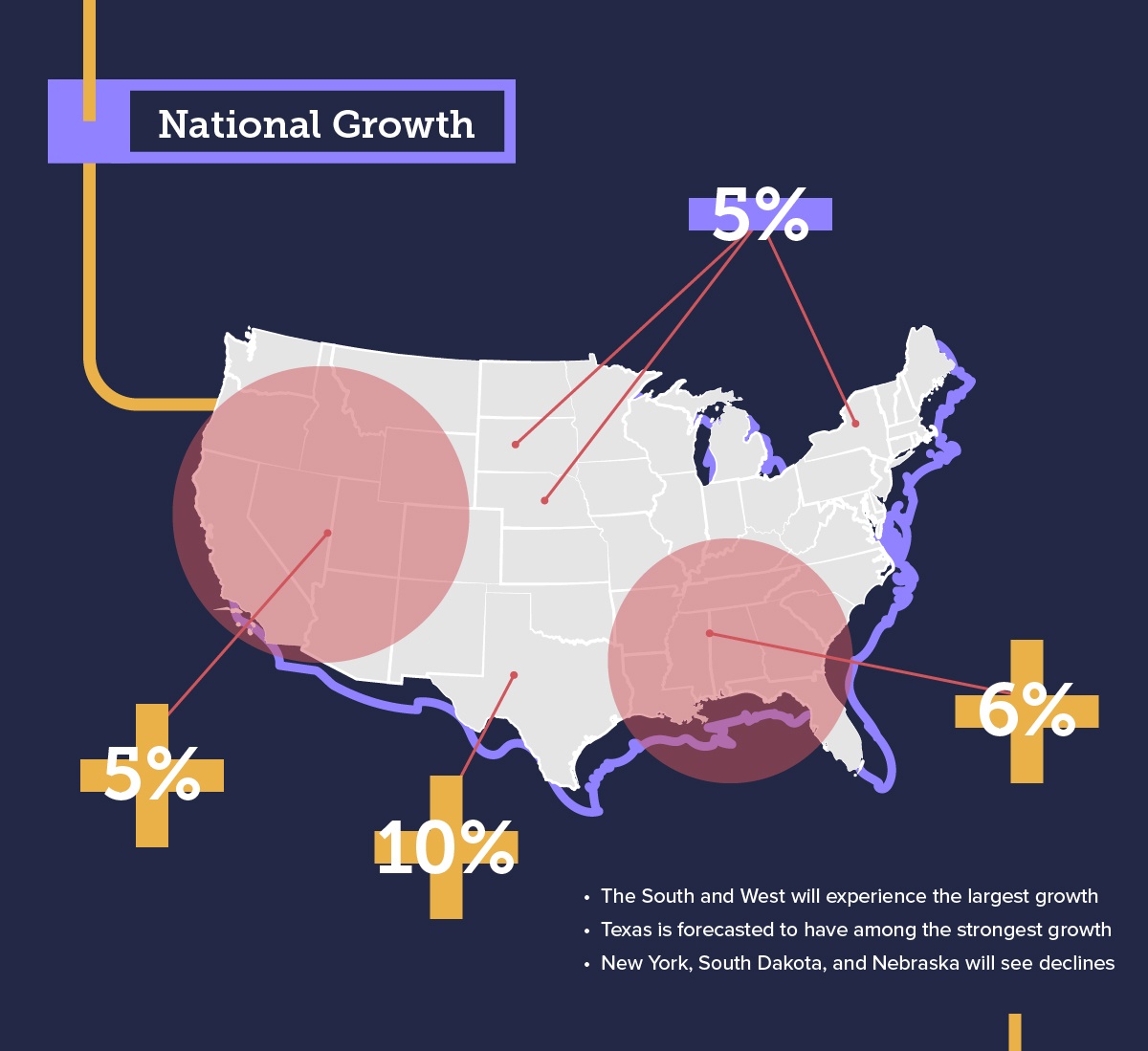

National Growth

Construction growth targets Southern and Western regions.

- The South and West are projected to see the largest growth

- Texas is projected to see the largest growth at 10%

- New York, South Dakota, and Nebraska will see declines

Millennials

Millennials on course to gain mortgage market share across all housing price points.

- Millenials are expected to reach 43% of mortgage originations by the end of 2018, compared to 40% in 2017

{{cta(‘716f21ae-9ce8-436d-94d1-3dd782154903’)}}

{{cta(‘ac77034d-7410-4538-8425-704209ee4ef2’)}}