Covid-19 Mapping Update – Impacted New Markets and Reporting Features

Recent market updates have been added to Built’s Covid-19 mapping solution for clients’ construction loan portfolios. As of March 26th, 2020, we have expanded our map to include Northwestern states where pandemic impacts have caused state and local officials to expand business restrictions. Built’s technical team is continuing to monitor and will add impacted markets on a daily basis, levering government notifications and public service announcements.

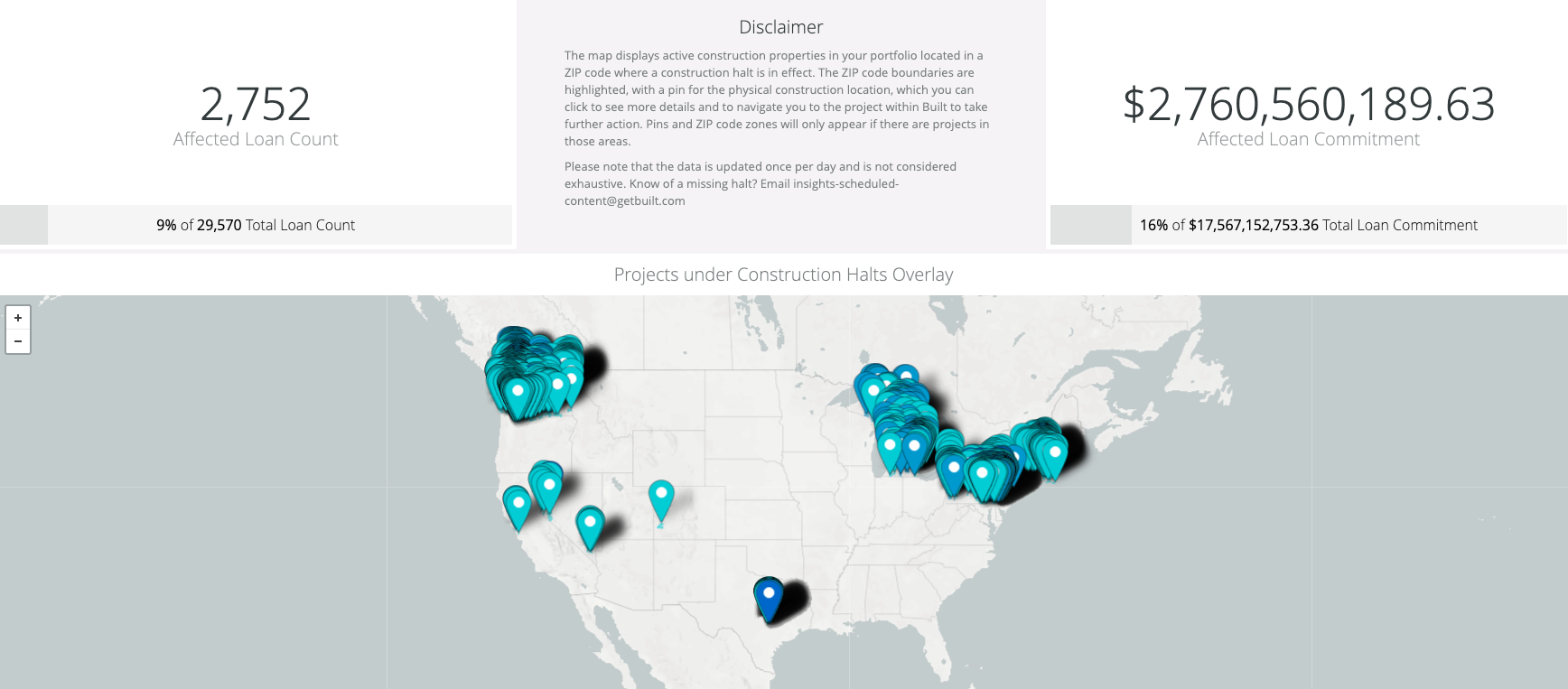

The graphic inserted below is a snapshot of aggregated commitment balances and loan unit counts for total construction loans managed by U.S. lenders (excluding Canada) on Built’s platform showing:

- $2.76B (16%) of $17.56B total commitments are in impacted markets

- 2,752 (9%) of 29,570 total loan units are in impacted markets

To help clients fine-tune their risk reporting, the Covid-19 Impact Map now reflects additional portfolio information to include:

- A count of properties impacted and the percentage of total loans affected

- Loan commitment on impacted properties and percentage of total loan commitments

- Property Use Types: Consumer (SFR Owner Occupied), Homebuilder (SFR Non-Owner Occupied), Commercial Real Estate

- Loan-to-Value: Quick reference drill-down to reference LTV

- Loan Maturity: Quick reference drill-down to monitor projects nearing maturity

Built will continue to provide updates and release enhancements to support construction loan portfolio risk management needs.