Converting to a Cloud-based Construction Accounting Solution: Simple Step-by-Step Guide

Key Takeaways:

- Cloud-based construction accounting solutions offer improved accessibility, less risk, more integration options, and are often more adaptable and customizable.

- Converting software is a complex process where planning and communication are key.

- Consult with a CPA or financial advisor so you know what reports and data are important to them.

- It’s important to clean up your existing data before you convert to ensure that you have a clean slate to start with.

- Remain flexible as the process progresses, as changes and setbacks are common.

When legacy desktop accounting solutions no longer work for your construction or development company, it may be time to switch to a more flexible, robust solution. With the increasing complexity of these solutions, cloud-based accounting software becomes more attractive. It allows teams to access the information they need from anywhere, at any time, on any device with an internet connection. This reduces the company’s burden of providing larger servers or desktop computers and puts the responsibility for data security and storage in the hands of the software provider.

Once a company decides to make a change in their accounting software, the process of implementation begins. Team members must work together to plan how they will make the transition, providing adequate time for the team to maintain their current workload while working on the required transition activities. With the clear process provided in this guide and the help of support staff, the transition should be smooth.

Key differences between cloud accounting and traditional accounting software

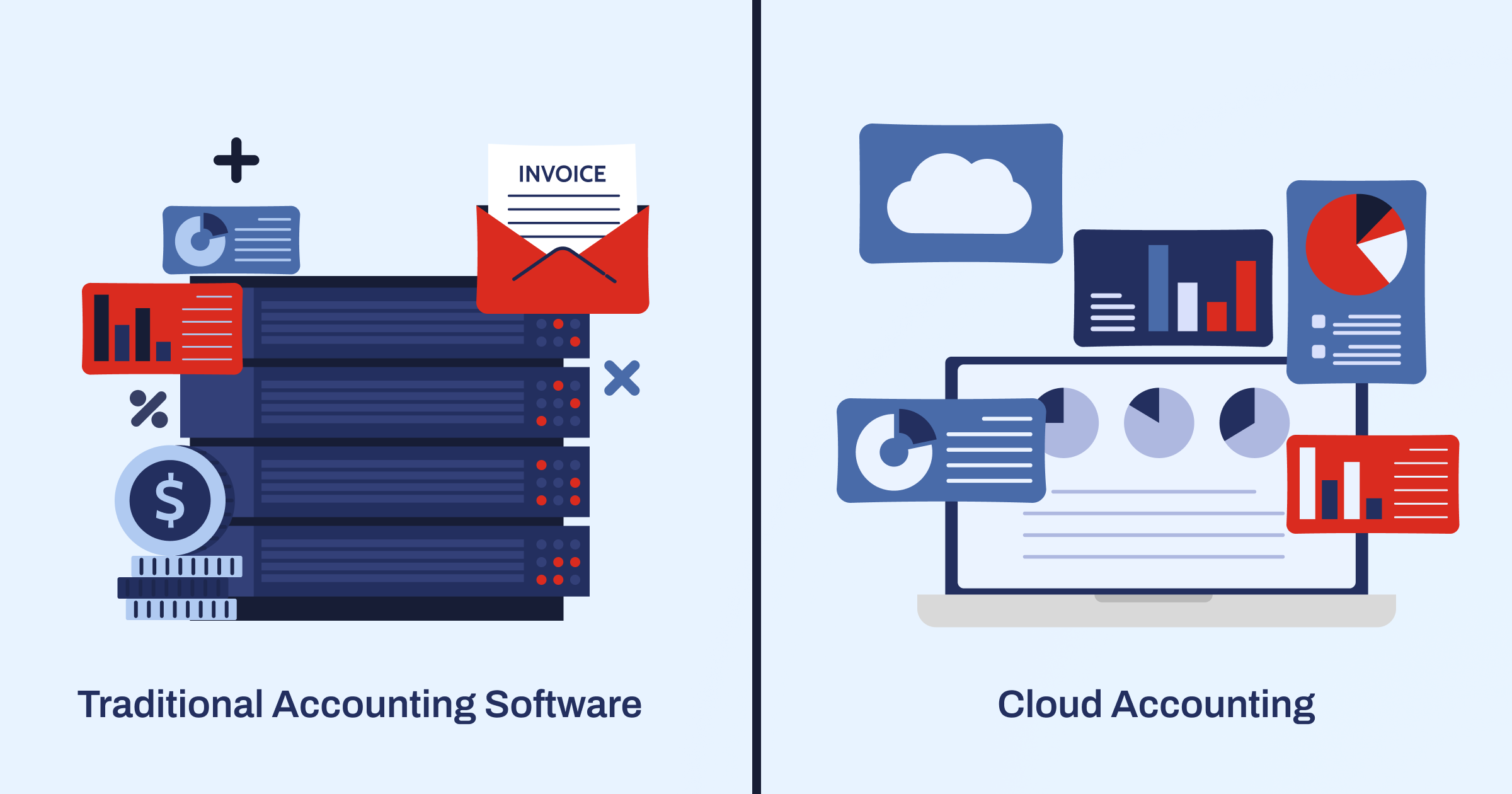

- Cloud accounting and traditional desktop accounting software are different in more ways than just where the software is installed.

Cloud accounting software is often sold on a subscription basis, where you pay for access to the software and your data for a specific time period. Monthly and yearly subscriptions are the most common. In contrast, desktop accounting software must be installed onto your server or computer, so it often requires you to purchase the software outright, which can be prohibitively expensive for some companies. Robust desktop construction accounting software packages can run in the tens of thousands of dollars, a cost few can afford. Cloud accounting software allows you to spread the expense out over time. - Hardware requirements also differ between the two types of software. Because cloud-based software is accessed through the internet, it doesn’t require any additional hardware – a standard laptop, desktop, tablet, or phone is often enough to connect you to the system. Legacy desktop systems may require a special server with a certain amount of memory or disk space to run the software, and each workstation will also require a certain amount of disk space to install it.

- Team members can more easily access the information in a cloud system since they only need an internet connection. This helps ensure that field teams are kept up to date and always have the latest data.

- Software hosted in the cloud is automatically updated with the latest revisions. The software may be down for a small period of time while these updates are implemented, but often this is done during low demand times. This saves your team the hassle and time it takes to perform regular software updates.

- When you host software on your system, you are required to provide your own data protection and security to protect your data and that of your customers. With hosted software, those protections are carried by the software company. This reduces your liability and risk.

- Companies often need to share information with outside entities (project owners, auditors, CPAs), and doing so can be difficult when the entity doesn’t have access to the software you use. Often reports are the only way for these parties to review your data. With a cloud-based platform, however, it’s easy to set up additional user profiles so these parties can have access to what they need. With robust security permissions, you can ensure that they only see what you want them to see, as well as protect the integrity of your data by only allowing them to view the data and not make changes.

8 steps to transition to new accounting software

Switching accounting software is a complicated process that requires a lot of planning, teamwork, and communication. Like a construction project, the work you do ahead of the conversion is just as important as the actual conversion itself.

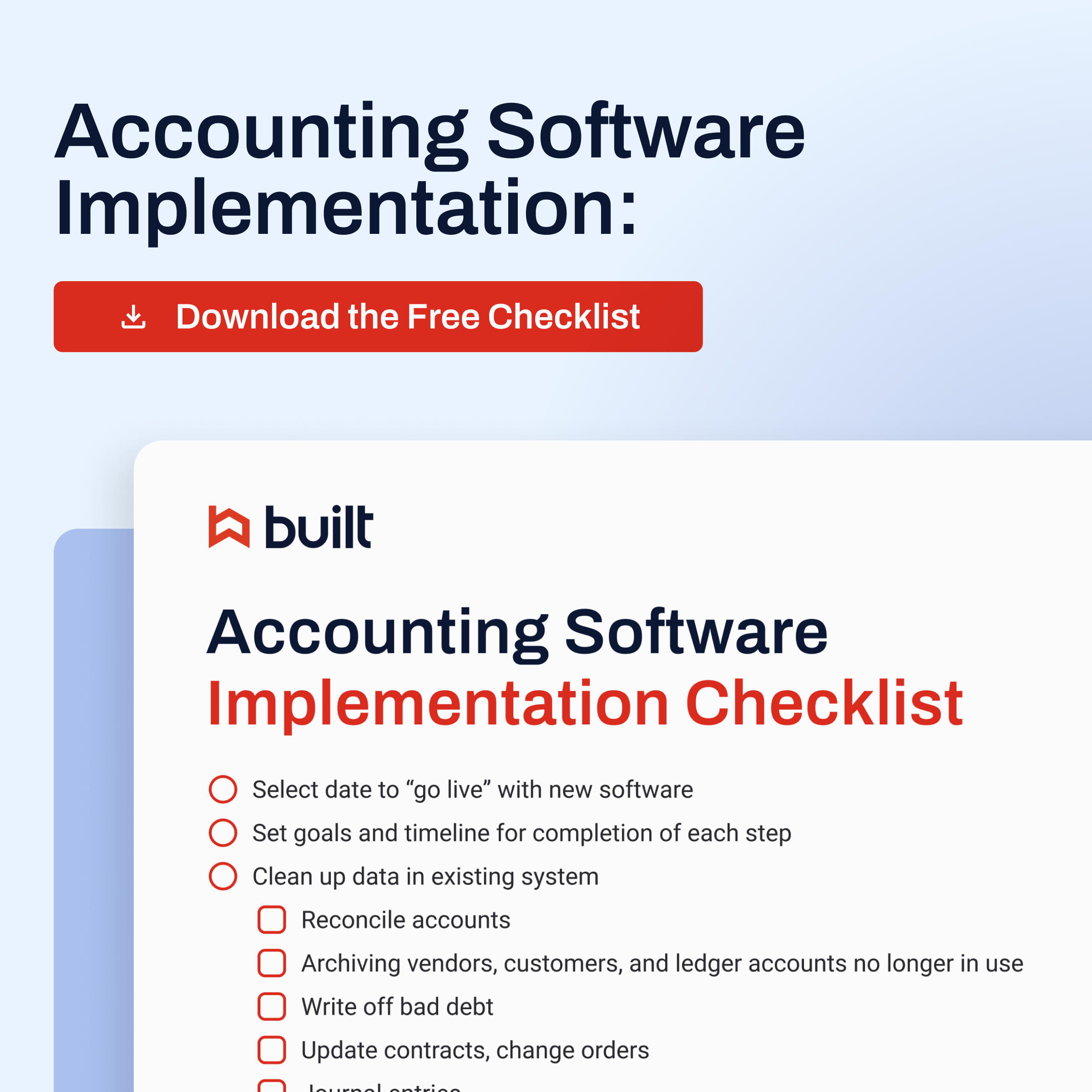

Here are the key steps to take during an accounting software conversion:

- Choose when to make the conversion. There is a lot of preliminary work, data conversion, and testing that needs to be completed before you can fully implement a new software program. So, allow your team at least a month or two to prepare before your “go live” date, which is the date you begin to use the new software for everyday entries. Check with your accountant for their suggestion on when it’s best to transition. Many companies choose to make the switch at the beginning of their fiscal year, but if your year ends with the calendar year, your staff may be burdened with end of year tasks during this period. Work with your team and your accountant to determine the best time to make the transition for you.

- Partner with your new software provider to provide training for your staff on all the functions they’ll be performing. Most software providers have online training videos or webinars you can use to get everyone up to speed. During this period, you may want to set up a testing ground in the software where your team can enter transactions without fear of messing up the “real” books.

- Throughout the process, keep your team informed on the process and how the transition is going. Make sure everyone knows what their role is, any deadlines they need to meet, and if the process is delayed for any reason.

- Clean up your existing data before transferring it to the new system. You don’t want to have to enter or import information you know is incorrect, so fix it in your existing system before you begin the transfer process. Your clean up should include:

- Reconciling bank and credit card accounts.

- Archiving or inactivating vendors and customers you no longer do business with or haven’t within the last year (you can always add them back in the new system).

- Archiving or inactivating general ledger accounts you no longer use.

- Writing off bad debt (accounts receivable).

- Updating change orders.

- Recording journal entries to prepare your data for transfer.

- Once the data is clean, run a trial balance report so you know what your beginning balances need to be in the new system.

- Before you begin the data migration process, be sure to back-up your existing system. This will help ensure that you don’t lose anything during the conversion process.

- Go through the new software set-up process. This process involves:

- Choosing company settings and options based on your business practices and requirements. Your new software support team should walk you through this process.

- Reviewing new workflows and how they affect how data is entered/imported into the new system. Be flexible with your current processes and be ready to adapt them as necessary.

- Import data, such as general ledger accounts, customers, vendors, etc. Many software packages can export and

import these lists as CSV or Excel files, making for a smooth transition and saving you data entry time. - Enter historical transactions up to the “go live” date (open AP/AR invoices, contracts, change orders, bank balances, etc.). Consult with your new software team to determine which transactions need to be entered into the new system. You may need to bring on additional temporary help to keep up with the daily transactions and enter historical data into the new system.

- Some companies may choose to enter data into both the old and new systems for a short period of time. This allows you to ensure that transactions are being recorded correctly and are being reflected in the appropriate reports. Note that this can be time-consuming, so plan for additional costs, either in overtime or hiring temporary help. It may take you longer than you planned to get everything ready to go live, so adjust the schedule as needed.

- When your “go live” date arrives, begin to enter transactions in the new system. Pull regular reports to ensure that the data is flowing correctly through the system. If a process isn’t working correctly, make changes where necessary. It’s important to remain flexible in your workflows as you learn the new software and its processes. Reach out to technical support and your training contacts for troubleshooting and workflow recommendations.

You’ll need to maintain access to your legacy software to reference it for historical data.

Change, even positive change, can be painful. Team members may get frustrated when they don’t know how to do something, certain tasks will take longer, and information may be difficult to retrieve for a while. However, most of these will fade with time as everyone gains experience with the new software.

When things get rough, you may be tempted to go back to the old system, but keep persevering. Growth is slow, and the rewards won’t be immediate, but they will come.

Conclusion

Transitioning to a cloud-based accounting solution is a complex process, but it can be made easier with proper planning. Open communication among team members and the ability to be flexible with timelines can help alleviate the stress that comes with transitioning from one software system to another.

Anytime you make a major change to how you run your business, it’s important to consult with experts to ensure that you’re getting the most from your investment. Consulting with a CPA is crucial when it comes to assessing your financial processes and the tools you use. If you don’t currently have a trusted CPA, make sure they have experience working with construction companies and are aware of the advantages of using cloud-based accounting platforms. Not sure where to start? Try Penny Lane and Diane Gilson.

The benefits of a cloud-based system far outweigh those of a traditional desktop system. Cloud-based software allows team members to access the data they need, at any time, from wherever they are, whether in the office or the field. It also provides real-time updates, allowing teams to make better informed decisions. With today’s integration options and ability to share data seamlessly between applications, teams can leverage their data even more through external productivity apps, without worrying about the accuracy or age of the information.