Construction Draw Software: A Guide for Owners and Developers

Construction draw software is a category of financial technology designed to manage how construction funds are requested, reviewed, approved, and disbursed throughout the life of a project.

This guide is written specifically for owners and developers managing construction capital. As projects grow more complex and are financed with layered capital and multiple stakeholders, manual workflows and spreadsheet-based tracking make it harder to maintain visibility, enforce draw rules, and keep capital moving on schedule.

Here, we explain how modern digital draw management platforms support draw requests, documentation validation, approvals, and audit-ready funding across both single projects and multi-project portfolios. You’ll learn how draw software differs from general project management or accounting tools, and which capabilities matter most as project volume and capital complexity increase.

This guide is not intended for contractors looking for job-costing or field-only project management tools. It focuses on the systems owners and developers use to control capital movement, reduce funding delays, and maintain consistent financial oversight across their portfolios.

Key Takeaways

- Construction draw software centralizes capital movement by managing draw requests, approvals, documentation, and disbursements in one system

- Owners and developers need more than project management tools to manage funding, compliance, and portfolio-level oversight

- Spreadsheet-based draw tracking does not scale as project count, capital sources, and approval complexity increase

- Purpose-built draw management platforms improve visibility, reduce funding delays, and support audit-ready controls across portfolios

What Is Construction Draw Management?

Construction draw management refers to the ongoing process of governing how construction capital is requested, reviewed, approved, and released throughout the life of a project—distinct from the draw process itself, which is the step-by-step execution of those activities.

For owners and developers, draw management is not a single event. It is a continuous discipline that ensures funding aligns with verified progress, approved budgets, and the rules of each capital source.

Effective draw management coordinates documentation, inspections, approvals, and disbursements across multiple stakeholders while maintaining a clear audit trail. As project volume and financing complexity increase, this governance becomes essential to controlling risk, pacing capital, and maintaining lender and investor confidence.

Digital draw management applies this discipline using structured, rules-driven systems rather than spreadsheets, emails, or manual tracking, making it possible to manage draw workflows consistently across multiple projects and capital structures.

What Is Construction Draw Management Software?

Construction draw management software is purpose-built technology, often referred to as construction draw automation or construction loan draw automation, that supports digital draw management by centralizing how draw requests are submitted, reviewed, approved, and funded throughout the construction lifecycle.

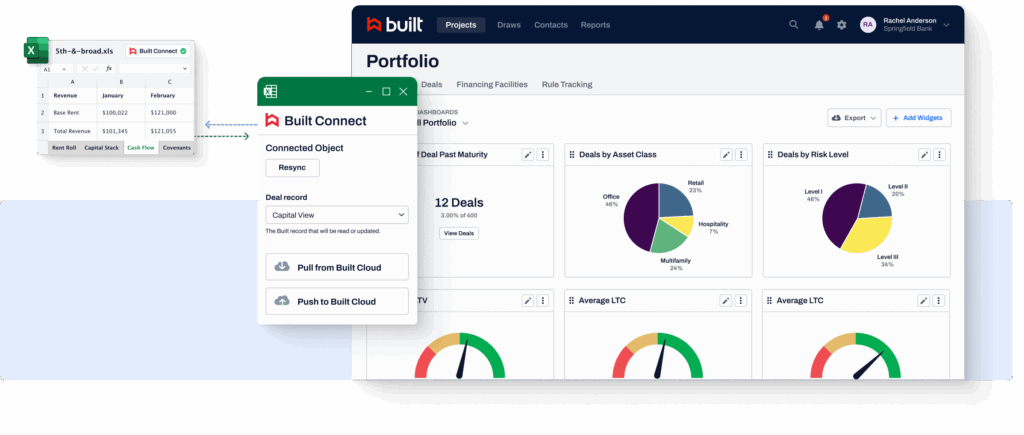

For owners and developers managing multiple projects or complex capital stacks, it replaces outdated tools like spreadsheets, email threads, and physical documents with a single system of record for construction capital movement, designed for speed, clarity, and compliance.

A typical draw request includes line-item detail, invoices, documentation of completed work, and proof of progress. Software platforms structure this submission flow and keep each step visible, auditable, and easy to track.

At its core, draw management software enables capital to move faster and more transparently. It reduces delays, enforces budget controls, and improves collaboration among borrowers, lenders, inspectors, and internal stakeholders by aligning everyone around shared data and structured communication.

How It’s Different from Generic Project Management Tools

Tools like Procore, Excel, or legacy accounting systems weren’t designed to handle the nuanced workflows tied to capital movement. While they may help track project progress or budgets, they fall short in a few critical ways:

- No built-in draw lifecycle logic: Generic tools can’t automate the draw approval path from submission to disbursement.

- Fragmented documentation: Manual uploads and spreadsheets lead to missing lien waivers, unverified invoices, and compliance risks.

- Lack of financial control: These tools don’t enforce funding thresholds, retainage rules, or lender-specific draw criteria.

- Limited portfolio oversight: They often lack roll-up reporting for visibility across dozens or hundreds of active builds.

And it’s not just anecdotal. A recent U.S.–focused Deloitte / Autodesk survey found 80% of construction firms acknowledged room to improve their data capabilities, with just 18% achieving daily actionable insights from project data.

Construction draw management software creates a consistent, repeatable process for how capital flows through a project. But adopting that kind of structure means moving beyond the tools that got you through early-stage growth. And for most owner-developer teams, that means confronting a familiar culprit: the spreadsheet.

Draw Management in Multi-Source Capital Stacks

As real estate deals become more complex, capital rarely comes from a single source. Developers now routinely structure projects with combinations of senior debt, mezzanine financing, preferred equity, and other private capital, each with its own disbursement logic, risk tolerance, and compliance requirements.

This layering adds meaningful complexity to the draw process. Each funding partner may require different documentation, apply unique approval criteria, or enforce distinct release conditions. When these requirements are not mapped to a unified draw structure, delays, rework, and discrepancies become common.

The risk of misaligned disbursements

Misaligned disbursement rules slow payments and introduce financial and compliance risk. Funds can be released out of sequence, overfund incomplete work, or bypass required review steps, exposing developers to covenant violations and strained capital partner relationships. Without software designed to reflect these variations, teams are forced to manage parallel workflows that increase error and reduce transparency.

Centralized draw management addresses this challenge directly. Purpose-built platforms allow owner-developers to define and apply the rules of each funding source within a single workflow. Draw requests route to the appropriate stakeholders, validate against source-specific criteria, and retain supporting documentation aligned to every layer of the capital stack.

For organizations managing multiple active projects, this capability is not optional. A draw management system that adapts to varying financing structures without manual rework becomes the foundation for consistent execution, faster funding cycles, and tighter financial control across the portfolio.

Why Draw Management Breaks Down In Spreadsheets

Spreadsheets can work for a single construction loan or a tightly managed budget. They don’t scale when owners and developers are managing multiple projects, layered capital, and growing stakeholder complexity. What begins as a practical workaround often becomes a structural risk.

Across development teams, the same issues surface repeatedly. Version mismatches across files, budget updates buried in email threads, and last-minute scrambles to assemble documentation when lenders, auditors, or capital partners request clarity. Internally, teams rely on different templates, naming conventions, or assumptions, making it difficult to maintain a consistent view of draw status or funding exposure.

The challenge extends beyond inefficiency. Spreadsheets lack standardization, real-time validation, and enforceable controls. There is no reliable way to flag anomalies as they occur, apply consistent approval logic, or ensure clean handoffs between finance, operations, and external stakeholders. A single outdated formula or misaligned draw log can trigger funding delays, budget overruns, or audit findings, particularly when reconciling draws across multiple active projects.

As portfolios expand, spreadsheets introduce more variability rather than more control. Owners and developers need systems that reflect how capital actually moves across projects, designed to manage real-time complexity, not static files.

The Construction Draw Process, Digitized

With manual tools off the table, the next step is a structured, digital approach that reflects how construction capital really moves. For projects financed through construction loans or layered capital structures, this automation reduces draw turnaround time while preserving compliance with loan terms.

Construction draws do more than release funds. They directly influence project momentum by coordinating people, documentation, approvals, and timing across multiple stakeholders. A digitized draw process replaces fragmented steps with a unified workflow that aligns capital movement with real project progress.

At the foundation of this workflow is the draw schedule. It should align to construction milestones or percent completion so funding is released in step with verified progress, not estimates or lagging updates.

Modern draw management platforms organize this workflow into four clear, auditable phases:

1. Draw Request

Authorized project stakeholders submit draw requests through a secure digital portal. Each request includes line-item detail, pay applications, and supporting documentation tied directly to the budget and draw schedule. Every action is time-stamped and logged, creating a clear record from the moment a request is submitted.

2. Validation

Required inspections, lien waivers, and supporting documents are reviewed and validated within the same system. Requests are checked against verified progress and predefined funding thresholds, reducing reliance on email attachments or offline reconciliation.

3. Approval

Approvals follow a structured, role-based path. Whether a draw requires a single reviewer or multiple layers of review across loan administration, construction management, or compliance, routing occurs automatically based on deal rules, dollar thresholds, or project stage. Each decision is recorded without manual follow-ups.

4. Funding

Once approved, disbursement instructions flow directly to the appropriate accounting or banking systems. This reduces handoffs, shortens funding timelines, and creates a complete audit trail covering approvals, documentation, and fund release activity.

For owner-developer teams managing multiple active projects, this structure delivers more than control. It creates consistency, predictability, and speed across every draw, helping teams maintain momentum while keeping capital partners aligned.

Construction loan draws vs. owner-managed draws

Construction loan draws are typically lender-driven. Funds are released based on lender requirements, inspections, and approval timelines, with the primary goal of protecting loan exposure. From the borrower’s perspective, this often feels reactive, with visibility limited to individual draw submissions rather than the broader capital picture.

Owner-managed draws operate upstream of that process. Owners and developers are responsible for coordinating documentation, approvals, budget changes, and timing across all capital sources, not just the construction loan. That includes equity, mezzanine financing, retainage, and internal approvals that may never appear in a lender’s system but still affect funding risk and cash flow.

This distinction matters because lender draw tools don’t replace owner-side governance. Even when a construction loan is in place, owner-developers still need a system that governs how draws are prepared, validated, and sequenced before they ever reach a lender. That’s where draw management software fits: providing control and visibility on the owner side, while supporting compliant construction loan draws downstream.

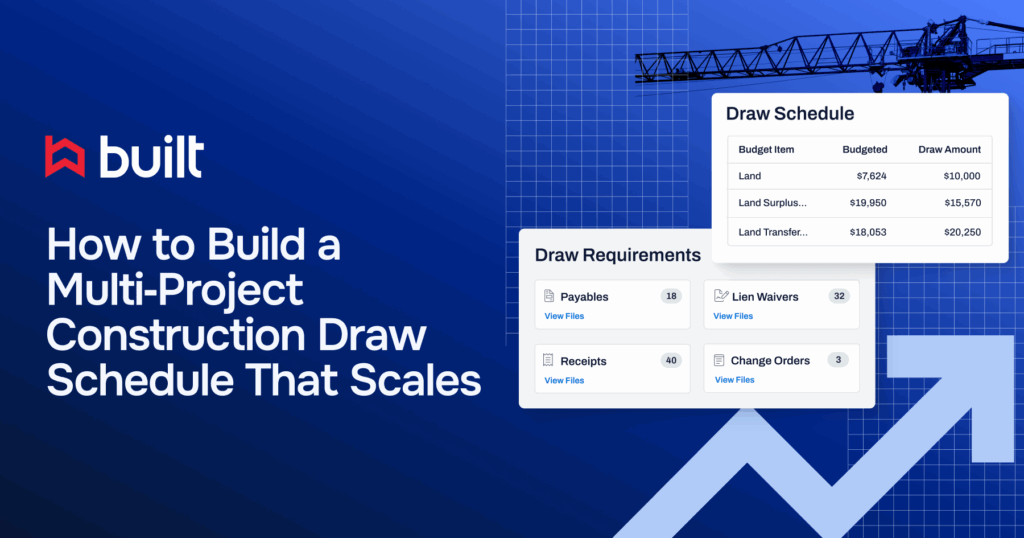

What a Scalable Draw Schedule Looks Like

Once draw workflows are standardized, the next challenge is maintaining visibility across the portfolio. A scalable draw schedule is a dynamic coordination system that aligns construction progress, capital pacing, and risk signals across every active project, letting you zoom out while keeping control at the line-item level.

At scale, draw schedules help enforce discipline. Payments stay tied to verified progress, and capital moves according to defined milestones, not gut feelings or back-and-forth emails.

In practice, this means being able to do the following:

- Spot projects that are outpacing funding or vice versa

- Flag overfunded builds before they become exposure issues

- Balance draw timing against seasonal constraints, resource availability, or lending cycles

- Identify delays or stalled builds not just by calendar but also by performance against plan

- Use detailed cost breakdowns to ensure payments align with actual progress

These aren’t things a spreadsheet can catch. A scalable schedule surfaces them in real time, so you’re never reacting after the fact.

Some developers embed draw timing directly into their portfolio planning, using historical funding patterns and construction pacing to inform how and when requests are released across builds. Larger portfolios often require more granular schedules that are flexible enough to reflect the unique financial rhythms of each project but structured enough to drive accountability at scale.

Owner-Developer Draw Tracking Spreadsheet

Track construction draws, budgets, and approvals in a single spreadsheet. Built for owner-developers managing draws manually.

How owner-developers manage draws across portfolios

- Standardize the draw workflow (same intake, validation, approval steps across projects)

- Centralize status + documents (one system of record for waivers, inspections, pay apps, approvals)

- Enforce rules by capital source (equity/debt/mezz rules applied consistently, not manually)

- Track draw pacing across projects (what’s ahead/behind, what’s stalled, what’s overfunded)

- Escalate bottlenecks early (missing waivers, stalled approvals, inspection delays)

- Maintain portfolio audit readiness (time-stamped approvals and complete draw packages)

The goal isn’t to manage more spreadsheets—it’s to run one repeatable draw operating model across a portfolio.

Replacing Manual Approvals and Pay Apps

Coordinating funding is one challenge. Documenting and verifying the details behind every disbursement is another. In many cases, pay applications, lien waivers, and supporting invoices still move through inboxes and shared drives, often with unclear versioning, missing signatures, or approvals stuck in limbo.

For developers overseeing multiple builds, that kind of manual routing creates blind spots. Delays in processing a single lien waiver can hold up a draw. Pay apps submitted in non-standard formats add review time.

And compliance checks that depend on tribal knowledge or last-minute document hunts don’t hold up to scrutiny when capital partners or auditors come calling.

Digitizing this layer means replacing loosely managed handoffs with structured document collection, pre-configured approval paths, and real-time validation. Roles are clearly defined, supporting documents are tracked automatically, and everything routes through a system that maintains continuity, even when project complexity increases.

The draw schedule should incorporate provisions for issues like retainage, which is withheld until project completion to ensure quality and contractual compliance.

Some teams start by mapping pain points using tools like a pay app and lien waiver tracker to assess where friction builds. Others go deeper into how automated documentation workflows reduce risk and sync funding, billing, and approvals into a single system of record.

Automating Off-Cycle Draw Approvals

Not every draw request arrives on schedule. Change orders, urgent costs, or unexpected delays often trigger off-cycle draws that fall outside the standard cadence. When managed manually, these exceptions cause confusion, slow down funding, and increase compliance risk.

With draw management software, off-cycle requests route automatically through pre-configured approval logic. Additional documentation requirements, dual sign-offs, and audit trails are built in, ensuring capital moves quickly but never at the expense of control. Developers gain the flexibility to address real-world exceptions while keeping stakeholders aligned and funding compliant.

Controlling Budget Changes and Draw-Linked Risk

Construction budgets are dynamic by nature. Line items shift, contingencies are tapped, and change orders surface mid-project, often under tight timelines. These adjustments aren’t outliers. They’re standard operating reality for developers managing complex builds.

The challenge is capturing those shifts in real time, across both hard and soft costs. Permits, site prep, design changes: if they aren’t logged consistently, funding flows can quickly fall out of sync with actual exposure.

Most issues stem from disconnects between financial oversight and field execution. Budgets may be updated in spreadsheets or routed through offline approvals, but if those updates don’t feed directly into the systems that govern draw releases, capital moves without context.

That’s where risk creeps in: funds released against outdated numbers, delayed recognition of overages, and missed chances to course-correct.

Draw-linked budget control means tying disbursements to real progress and verified updates, not assumptions. It’s how developers protect margins, uphold accountability, and make confident portfolio decisions.

Signs You’re Losing Budget Control

When budgets shift faster than controls can keep up, risk becomes systemic rather than situational.

- Contingencies are drained with no centralized log of usage or rationale

- Draws reflect outdated budget versions or unapproved reallocations

- Change orders are approved late or, worse, funded before approval

- There’s no unified view of exposure across active projects

Why Draw-Linked Budget Oversight Matters

A connected draw platform brings these moving parts together. Every budget adjustment, whether it’s a scope change, a line-item reallocation, or a new contingency request, is tracked within the same environment where draw requests are created and approved.

That means the following:

- Budget adjustments are surfaced to project owners, contractors, and lenders within a shared system, ensuring changes are tracked and approved before funds move.

- Approval routing happens with controls already in place

- Funding aligns with the latest financial position, not a static baseline

How developers are operationalizing budget discipline

Many owner-developer teams start by mapping pain points using a budget contingency tracker. From there, they evolve toward systems that expose real-time shifts in cost structure and tie every draw release to up-to-date financials and pre-set approval logic.

What Lenders and Auditors Expect from Developers

Draw requests don’t just move money. They signal credibility. For lenders, fund administrators, and auditors, every draw submission is a window into how a project is managed, and expectations are only rising.

Capital partners increasingly require consistent, time-stamped documentation that shows exactly what work was completed, when, and how it aligns with the approved budget. Retroactive adjustments, missing backup, and vague line-item changes raise red flags, and often delay funding.

From the lender’s perspective, friction usually stems from the following:

- Disorganized or partial documentation

- Budget revisions that lack rationale or audit trails

- Draw packages that don’t follow a consistent format

- Late-stage requests to backfill gaps in compliance

These issues are operational risks and are why more capital providers now require structured draw schedules and digital approval logs as part of their underwriting criteria.

Purpose-built software helps developers meet those expectations head-on. It standardizes how information is submitted, ensures every update is logged in context, and generates audit-ready records automatically. When draws follow predictable patterns, approvals move faster, and trust deepens across the capital stack.

For developers scaling their portfolios or working with institutional partners, this kind of process maturity is a competitive advantage. It doesn’t just help secure funding, it protects it.

Gaining Full Project Visibility

As development teams take on more volume, the challenge shifts from managing individual projects to understanding the full shape of a portfolio in motion. It’s no longer just about what’s funded or approved. Now, it’s about what’s lagging, what’s stalled, and what’s trending off-plan.

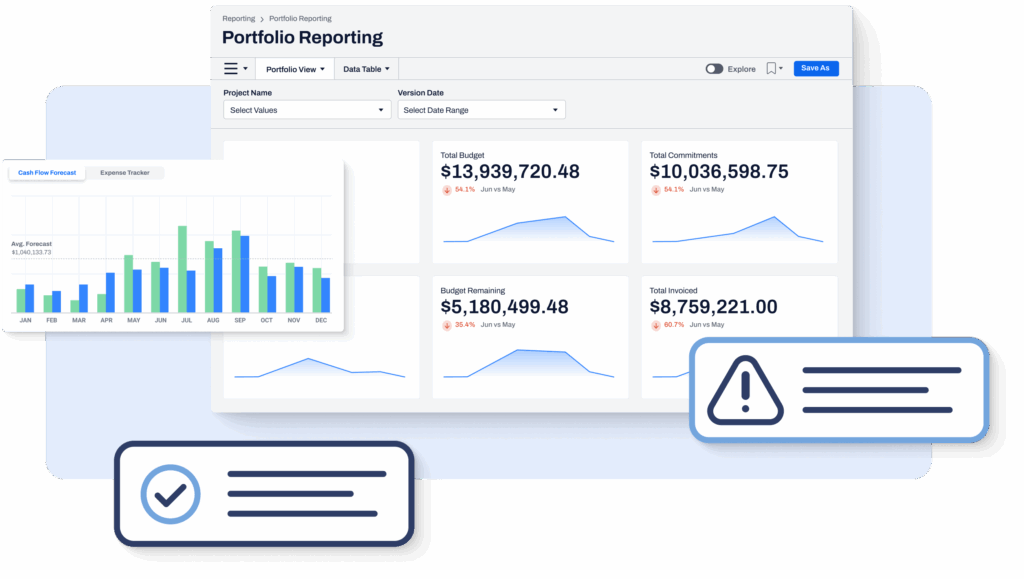

Project managers rely on real-time dashboards to monitor project health and identify potential issues early.

That requires a different kind of visibility: one built around signal detection, not just task completion.

What the Most Effective Teams Monitor

High-performing owner-developer teams track construction progress not by static timelines, but by key health indicators embedded in their dashboards, including the following:

- Stale Loans: Projects that haven’t advanced in draw or inspection activity within a defined window

- Overdrawn Projects: Builds where capital outflows have exceeded verified construction progress

- Low Pacing Metrics: Projects falling behind planned timelines based on percentage complete vs. time elapsed

- Past Maturity Flags: Loans approaching or exceeding contractual maturity dates without closeout

- Payment Schedules: Monitoring payment schedules to ensure timely disbursements and maintain project cash flow

These indicators give teams a clearer picture of which projects are healthy, which need attention, and which need proactive action to prevent delays or cost overruns.

Why Static Reporting Falls Short

Conventional reporting often lacks the context or frequency to catch issues early. By the time a monthly update flags a risk, the window to intervene may have closed. Even the best spreadsheets or emailed reports can’t replicate the real-time value of a live dashboard built on active project data.

From Construction Start to Final Stabilization

For developers building to hold or managing multiple capital sources, visibility must extend beyond the draw itself. Full-cycle dashboards help teams track projects from initial funding to lease-up, disposition, or refinance, tying each phase back to financial performance and delivery timelines.

Teams exploring this approach often begin by evaluating their existing blind spots using a project tracking template, then they look at how lifecycle dashboards and pre-close-to-stabilization tools can unify every stage of the process.

Get Started with Smarter Draw Management

If your draw process still depends on disconnected systems or improvisation, now’s the time to rethink what’s possible. Modern development teams move capital faster and with more confidence and control. Many teams begin improving draw turnaround times and portfolio visibility within their first few projects, without disrupting active construction work.

Whether you’re managing two projects or two hundred, the shift to a structured, connected draw process can save time, improve team alignment, and reduce risk across the board.

Start by asking a few questions:

- Are your draw approvals and funding timelines consistent?

- Can you track draw progress and budget shifts across every project?

- Is your documentation process audit-ready at any given time?

- Do you have a single view of risk signals across your portfolio?

If the answer to any of these is “not really,” you’re not alone, and there’s a better way forward.

See how owner-developer teams are evaluating their options in this comparison of draw management platforms, and explore how a connected approach can streamline your workflows, improve capital performance, and reduce project risk from day one.

Construction Draw Management Software FAQs

Can we set different approval workflows for different loan types or partners?

Yes. Construction draw management platforms allow teams to configure approval workflows based on deal structure, funding source, or project requirements. This makes it possible to route requests differently for senior debt, mezzanine financing, or equity partners while maintaining consistent oversight and governance across the entire portfolio.

How does the system handle retainage and funding thresholds?

Draw platforms support retainage rules, disbursement limits, and funding thresholds enforced against verified construction progress and inspection results. These controls are enforced automatically within the workflow, reducing manual tracking and helping ensure funds are released in accordance with contractual terms and inspection results.

What documentation gets tracked in the draw process?

Draw requests typically include pay applications, invoices, lien waivers, inspection reports, and approval records. Construction draw software centralizes these documents, time-stamps each action, and preserves a complete audit trail that can be shared with lenders, auditors, or internal stakeholders as needed.

Can I see draw performance across all active projects?

Yes. Portfolio-level dashboards provide real-time visibility into draw status, funding pace, and potential risk signals across all active projects. This helps owner-developers monitor cash flow, identify stalled activity, and prioritize attention where it’s needed most.

How quickly can we get up and running with draw software?

Most teams begin with a small number of projects and expand as workflows become standardized. With structured intake forms, configurable approval logic, and integrations with accounting or inspection systems, implementation is typically straightforward and does not require disrupting active construction work.

Mark Murphy leads OGC Sales at Built, where he is responsible for accelerating adoption of payments and standalone solutions purpose-built for real estate owners, developers, and general contractors. He brings deep experience across sales, general management, and operations in technology-driven businesses.

Prior to joining Built, Mark served as General Manager at Apex Service Partners and Operating Executive at Alpine Investors. He also spent over six years at Flexport, where he held multiple leadership roles including General Manager for the South and Northeast regions, and Director & Acting General Manager for San Francisco and Northern California. Earlier in his career, Mark was Chief Operating Officer at Oolong, an INC 500-recognized international trading business.

Mark holds a degree in Mechanical Engineering from Stanford University, where he captained the Varsity Men’s Rowing team.