Why we raised $21M to fix construction lending

In 2014 we set out to help banks and other lenders improve the way construction lending works with technology. After first-hand experience with the frustrations of managing residential, commercial, and land development construction loans, we knew that modern technology had to be introduced to improve this complex area of lending.

Today we’re thrilled to announce that we’ve raised a $21M Series A investment.

We have two new partners that we’ve spent the past nine months getting to know. Index Ventures led the round with participation from Nyca Partners and some of our awesome existing investors.

The Promise of Built

Most of us probably don’t think too much about how capital gets deployed into construction projects, where the money comes from, or why it’s so important for our economy. Yet construction finance is the lifeblood of the entire $1.2 trillion U.S. construction industry and impacts everything from housing and commercial real estate availability and affordability to job growth and GDP.

We work with banks and other non-bank lenders to bring this critical area of lending into the 21st century.

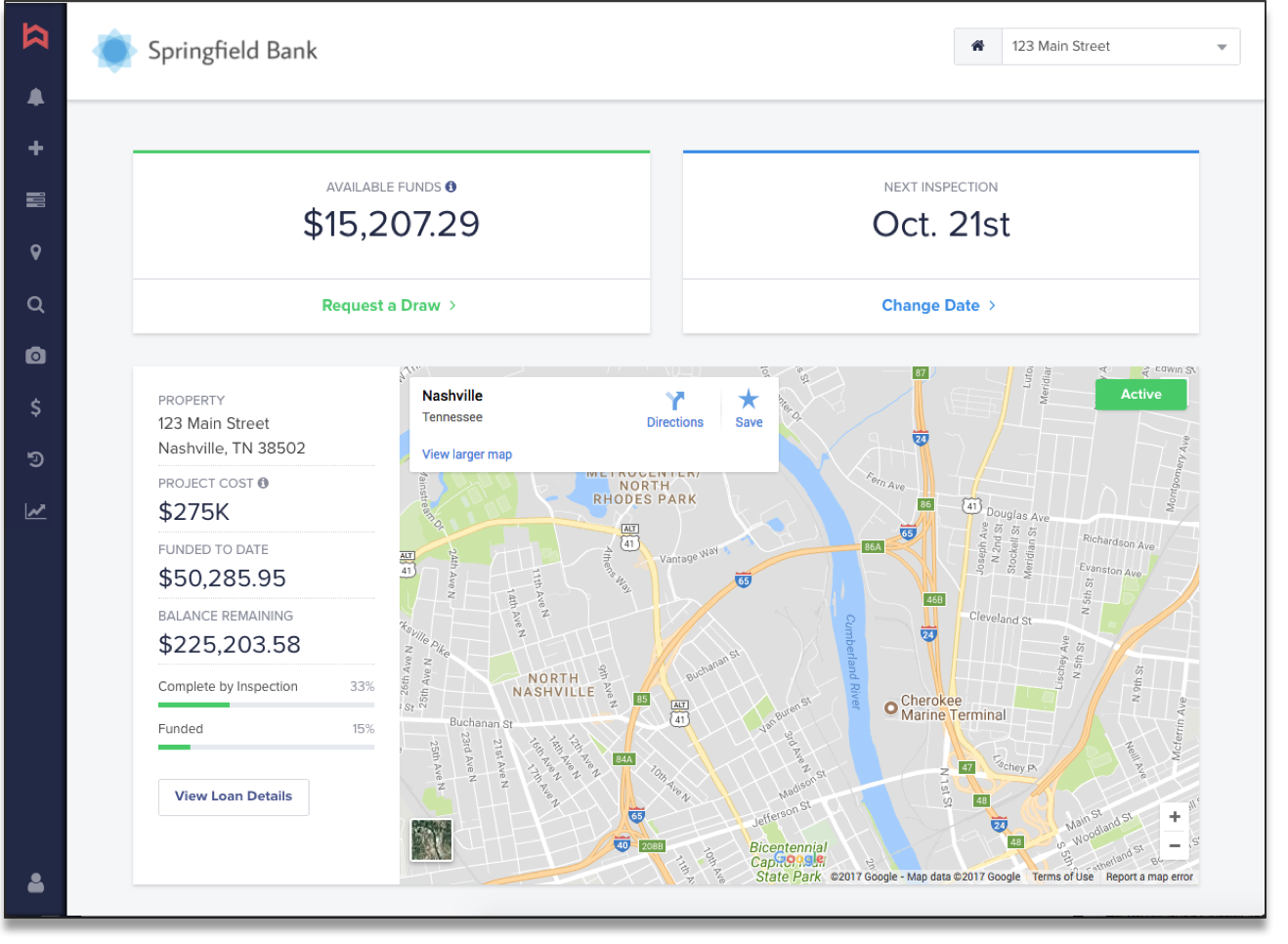

By using technology, we can help lenders reduce risk through data driven decisions, money can move faster into the communities we live in, and we can provide greater transparency to everyone involved through a convenient, digital experience.

This is how we’re changing the way the world gets built.

The Current State of Construction Lending

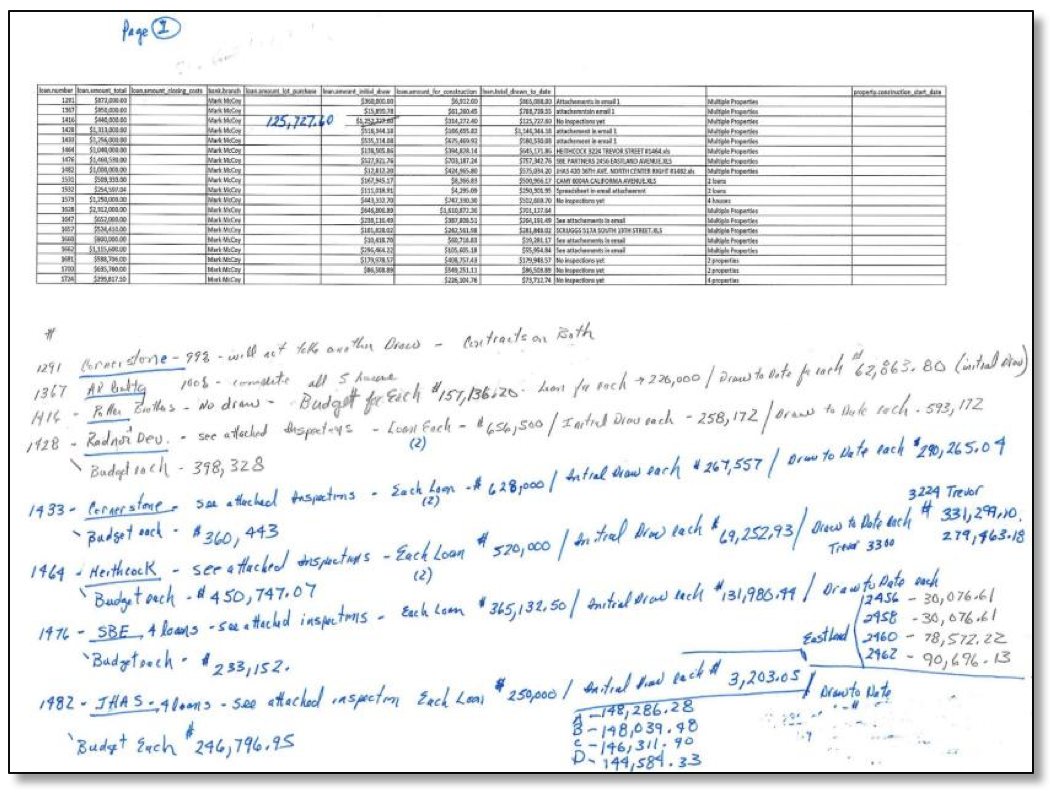

One of our early bank clients said that “unlike most loans, when you close a construction loan, the real work begins.” They couldn’t be more right. That’s because servicing a construction loan requires constant monitoring of the asset being built with “draws” taking place on the loan as construction is completed. This is how a lender ensures every dollar is actually going into their collateral and that they remain in first lien position throughout the process. To do this effectively, construction loans require constant coordination between lender staff, borrowers, builders/contractors, draw inspection vendors, architects, title companies, and more. Today these stakeholders are completely disconnected and all communication takes place over emails, phone calls, and faxes. Not surprisingly, there is often an information disparity between parties and each disbursement of funds is slow and costly.

Current lending technology just wasn’t designed to handle the nuance of how construction lending operates. As a result, loans often live on spreadsheets outside of the other systems a lender uses until construction is complete.

Some of the biggest reasons this problem has persisted for so long:

- The fragmentation of the industry means that construction loans are a relatively small portion of total assets for most lenders and therefore don’t get a lot of attention.

- Different types of construction loans have very different requirements for how they are serviced (lending money to a consumer to build or renovate their dream home works very different than lending money to a home builder building a subdivision or a developer building a skyscraper).

- Every state has different statutory laws that impact construction loans.

- The technology to solve the problem the right way didn’t even exist until recently.

All of this created the perfect storm for an entire segment of lending to be lost to innovation.

A Better Way to Manage Construction Loans with Less Risk

Spreadsheets and emails aren’t enough. Lenders should feel confident in the construction loans they originate and have access to the data they need to make informed decisions while managing their portfolio and serving their customers.

The Built platform was designed to simplify the complexity of how construction loans are monitored and serviced by bringing the entire process online. Our software complements a lender’s other key systems (commonly loan origination and loan accounting/core/servicing) and transforms the draw management process on all types of construction loan products. Lenders can now invite all key stakeholders into the process through Built so that there is real-time transparency into what’s going on and draws can process faster.

Sound Interesting?

If you’re a lender and the challenges described here sound familiar, we’d love to learn more about your business and see how we can be helpful. We want to make your life better and your borrowers’ lives better!

If you’re a homebuilder or commercial developer and you think the lenders you work with could benefit from speaking to us, please make introductions. The faster we help them, the faster we can help you!

It Takes a Village

Thank you to the amazing Built team for your commitment to improving the way the world is built and to serving our clients. The founding team of Scott Sohr, Andrew Sohr, and myself couldn’t be more proud that we get to work with you and that you have set the bar high for future additions.

Thank you to our early adopters for all of the invaluable insights, patience, and generous contributions of your time. Without you and your belief in what we’re doing, we couldn’t continue to make Built better and more helpful.

Thank you to our investors and advisors. You’ve believed in us from the beginning and we are beyond grateful for your continued support. To our new partners, we are humbled by your belief in us and now let’s go change the way the world gets built!

This is just the beginning!

Read the full press release on our anouncement here.