6 Tips for General Contractors to Speed Up Your Payment Process

Having a reputation as a slow-paying general contractor can significantly cost your business, both in reputation and in higher costs. When subcontractors and suppliers know they must wait for payment, they raise their prices. They do this to cover additional expenses, like interest and finance charges, incurred when they don’t have the cash flow to pay their bills. Some will even refuse to work with GCs that don’t pay on time.

Streamlining and speeding up your accounts payable payment process is a good business investment because it pays off in many ways, some of which are listed below. After that, we’ll dive into some tips for accelerating your payment process and show you how Built can help.

Advantages of paying your vendors faster

- Early payment discounts – Material suppliers often offer discounts if you pay your bills within a short period of time. Subcontractors may also extend a discount in exchange for early payment. Don’t be afraid to ask for them.

- Avoid interest and late fees – Failure to pay bills within the payment terms can result in interest charges and/or late fees, which can add to overhead costs.

- Improve relationships – Paying earlier can help improve vendor relationships, as you’re contributing to the financial success of their businesses.

- Boosts reputation – Contractors and suppliers talk, and your payment performance, whether good or bad, is sure to be a hot topic. A reputation as a slow payer may deter some from working with you.

- Better pricing – As your relationships and reputation improve, vendors may show their appreciation with lower pricing and priority service.

- Lower overhead – By reducing the time your team spends processing payments, overhead costs are reduced.

- Improved credit history – Faster payments contribute to a positive credit history, making it easier to get financing when needed.

Tips for speeding up the payment process

1. Embrace automation

There are many ways to use automation in payment processing. Look for solutions that offer:

- Automated invoice processing – Software uses optical character recognition technology to capture invoice data, reducing time spent on manual entry and preventing errors.

- Digital payments – Implementing digital payments, like ACH and EFT, saves time over manual check processing and costs less. Recurring payments can be scheduled automatically, further reducing the time spent.

- Workflow automation – Electronically routing invoices for approval speeds up the process and prevents lost information. By setting due dates and sending reminders, these systems can help keep payments on schedule.

- Benefits – Automation will help improve efficiency and accuracy, save money, reduce the amount of paper used, and increase profits.

2. Streamline invoice management

Make the process quicker and smoother for vendors by improving your invoice management system with these tools:

- Electronic invoicing – Encourage vendors to submit invoices electronically to save on paper and reduce transit time.

- Centralize invoice storage – Create centralized electronic storage for invoices. Ensure everyone has access to them and that they are searchable to help reduce the number of lost invoices.

- Provide invoice guidelines and format – Provide vendors with clear guidelines on the information required on each invoice and how to format them. You may want to provide a standard invoicing template to ensure you get everything you need.

- Benefits – Improved invoice management reduces paper used, saves time, gives team members access to real-time data, and simplifies the process for your vendors.

3. Optimize payment processes

Streamlining your payment processes can help you save both time and money.

- Know payment terms – Communicate clearly with vendors about their payment terms and take advantage of early payment discounts when offered.

- Use a payment calendar – Create a calendar to track payment deadlines and help ensure that payments are processed in time to meet them. Schedule payments ahead of time or in batches to improve efficiency.

- Offer payment portals – Use vendor payment portals that allow them to track payment status and update their information securely.

- Benefits – Clear payment processes can save money, ensure timely payments, and simplify vendor communication.

4. Improve internal communication and teamwork

Eliminate confusion and improve efficiency with collaboration and open communication among your internal team.

- Collaborate with the entire team – Work with all departments, including procurement, project management, and accounting.

- Clearly define roles and responsibilities – To help eliminate confusion and delays, define roles and responsibilities throughout the invoicing and payment process.

- Perform regular process reviews – Ask your internal team and vendors to review the payment process regularly to identify bottlenecks and areas for improvement.

- Benefits – Improving internal communication leads to greater collaboration, reduced processing delays, and continual improvement of all processes.

5. Leverage software and technology

Invest in the latest in software and technology to help make the process as efficient as possible.

- Use cloud-based accounting software – This will streamline the payment process, improve accessibility, and provide supervisors and managers with real-time updates.

- Explore payment automation platforms – Many software solutions offer advanced features like invoice matching and fraud detection.

- Benefits – Investing in the latest technology helps streamline processes and communication, increase data security, and improve efficiency.

6. Improve vendor communication

Providing your team and vendors with the tools to improve communication will reduce time spent on calls and emails.

- Be proactive – Keep vendors informed about payment status and delays.

- Use a vendor portal – Provide a system for vendors to check payment status and update their banking information securely.

- Benefits – Improving vendor communication reduces time spent answering calls and emails and helps keep vendor information secure.

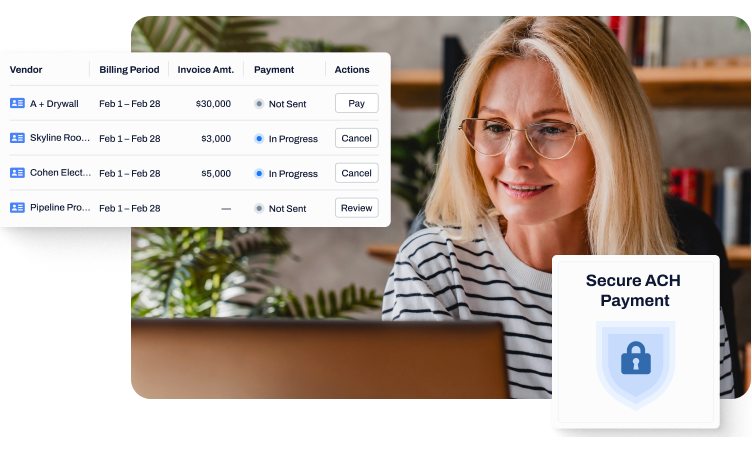

How Built can help

- Invoice Management

- Collect and store all invoices in one place, with real-time accessibility from anywhere.

- Provide guardrails for invoicing to help ensure that vendors submit a correct invoice the first time.

- Parallel or sequential electronic invoice approval routing.

- Open communication with vendors regarding compliance documentation, required revisions, and payment status.

- Digital Payments

- Quickly and easily pay multiple invoices at the same time.

- Communicate about payment status, compliance documents, and lien waivers all in one place.

- Secure vendor onboarding.

- Built follows strict SSL, SOC 2, and Data Privacy regulations, so you never have to worry about the safety of your money.

Related Posts

The 4 Best Construction Draw Management Software for Owners and Developers (2026 Review)

How Draws and Payoffs Really Work in Builder Finance (Borrowing Base vs Master Guidance Line)

Want to learn more?

Connect with our team for a customized demo and see how Built can streamline your workflows and boost your business.