4 Essential Tips to Improve Cash Flow & Grow Your Construction Business

Maintaining positive cash flow is especially important in construction, as margins are typically tighter and payments often take longer than in other industries. In addition, in today’s tight labor market, subcontractors may choose to avoid projects with slow-paying GCs–making it more important than ever to keep your project’s cash flows on track. Fast, fluid cash flow allows you to cover current expenses, start new projects faster, attract more subs, and grow your business. Below are four strategies to help you improve cash flow to fuel growth for your construction business.

Setting aside time to forecast your expenses and cash flow for the coming year helps ensure you’re creating a budget that is accurate and feasible–preventing financial issues down the line. Proactive financial planning helps lay the groundwork needed to successfully manage a construction project from start to finish. For example, proper cash flow planning can help ensure you have enough cash to sustain your business throughout the slow winter months or handle unexpected expenses.

After forecasting cash flow, payments need to be monitored closely to ensure your financials stay on track throughout the project. In the past, tracking cash flow was an arduous manual process that required significant administrative resources and left the door open for human error. This challenge was amplified by the wide array of jobs and change orders involved with any given construction project. Luckily, technology like Built’s Payment Management has made managing cash flow much more efficient and accurate–allowing you to easily track and manage payments throughout the life of a project.

Establish a Consistent Payment Schedule

Having a consistent payment schedule is essential to good cash flow. Paying invoices too early can leave you low on cash. Paying late can cause project delays, as your subs won’t be able to pay their subcontractors or suppliers–resulting in halted work or liens on your project. Late payments can also result in financial penalties and damaged relationships. Paying invoices on the due date when you’re able will help you keep cash on hand as long as possible while avoiding the many pitfalls of late payments. However, making on-time payments to your subs without negatively impacting cash flow is contingent on you receiving timely payment from the project owner. Digital payment management solutions enable you to promptly collect all necessary compliance documentation and conditional lien waivers from your subcontractors when they submit their payment applications. These can be easily downloaded in bulk and sent to the owner to facilitate a faster draw process.

It’s important to note that payment schedules aren’t one-size-fits-all. In construction, creating a payment schedule can be especially difficult due to varying contract types. In addition, if they have the capital, some GCs prefer to pay their subcontractors on net 30 terms to retain talent and take advantage of early payment benefits. The many variables involved with payment scheduling coupled with manual accounts payable processes that lack visibility and financial controls can create a large amount of risk. Technology can significantly streamline the payment scheduling process to help mitigate this risk and ensure your subs are always paid on time–regardless of the contract type or payment method.

Digitize & Automate Your Payments

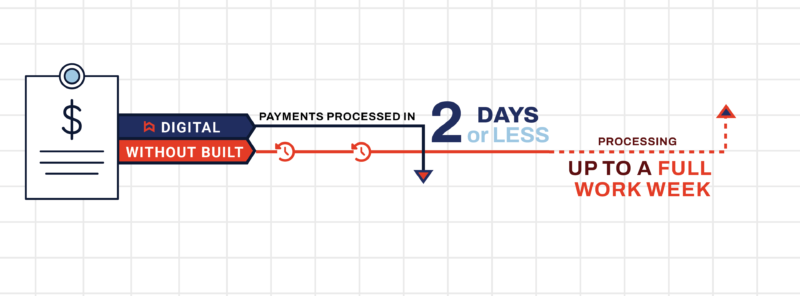

Picking up on the previous tip–establishing a regular payment schedule can be challenging when paying with checks, as payment data will need to be manually input into your accounting system. In addition, manual payments are slow and difficult to track. In today’s tight labor market, many subcontractors simply avoid bidding on projects with general contractors that pay late. Adopting electronic payments such as ACH or credit cards allows for easy, auditable payment tracking, instant money transfer, and automated payment scheduling. Digitizing payments also provides flexibility to quickly pay your subs via the method of your–or their–choosing. For example, payment management software like Built allows you to easily schedule ACH payments that are automatically disbursed upon receipt and approval of an unconditional lien waiver. By digitizing payments, you can rest assured that your subs will always be paid on time.

Remove Payment & Communication Barriers

In construction, cash flows downstream. So, in order to pay your subs on time and avoid financial penalties, General Contractors need to be paid on time by the project owner. To receive payment from the owner, GCs must submit a payment application that contains aggregated information from your subcontractor’s payment applications. Therefore, to ensure smooth cash flow, you must enable your subs to complete and submit their payment applications easily, efficiently, and without errors. When subs use outdated, manual processes to complete payment applications, the process takes much longer, and the likelihood of errors increases–all of which can disrupt cash flow. Built Payment Management simplifies invoicing by enabling your subs to accurately complete payment applications based on an approved schedule of values and sign conditional lien waivers each pay period–all from one centralized platform. When your subs can submit payment applications quickly without errors, you can collect, review, approve, and export those applications more efficiently. This efficiency allows you to accelerate pay app submission, so you can get paid faster, and in turn, pay your subs faster.

Enabling efficient communication is another highly-effective way to keep money moving. Built makes it easy to set standard updates and reminders (such as when compliance documents are required) to help reduce back-and-forth communication between key stakeholders and keep the payment process transparent. Built also provides a central portal for fast, reliable communication to quickly work through any problems or questions to prevent delays and keep cash flowing.

Take Control of Your Construction Payments

In order to grow, your construction business must maintain a consistent and reliable cash flow to cover expenses and fund new projects. However, construction is complex and it can be challenging to expand your business when your back office is drowning in paperwork and outdated payment processes. In addition, if your payments are slow and unreliable, subs are more likely to avoid working with you.

Implementing the above strategies coupled with a digital construction payment management solution like Built will help improve cash flow and keep your construction business thriving. Built’s solution helps all parties on a project take a more streamlined approach to project billing and payments. Increased operational efficiency ensures you can improve cash flow to tackle more projects and grow your business without taking on additional headcount or risk.